Is Robinhood made for investors?

About a month ago, I've started to use Robinhood and was disappointed by their app. It is not suited for the medium (three to eight years) and long (more than eight years) term investments, which, I believe, the majority of their users are most interested in.

I'm not trying to bash Robinhood. They have an excellent product that has made the investment available to many people. This is my attempt to sort out what is wrong with their app, why it works in a certain way, and how it can be improved.

In the past, I spent some time actively trading on stock and currency markets. I have done various things such as scalping, intraday trading, trading with leverage, algorithm trading and trading with neural networks.

This experience has taught me that active trading is a full-time job. You must have enough experience, knowledge and time to be successful and make money. It also requires the appropriate mindset and emotional stability.

This time I decided to rethink my approach and instead focus on investing. I am planning to buy and hold stocks for at least five years. In addition to the growth of the stock itself, I am also interested in receiving dividends.

I decided to try Robinhood because it seemed to be a convenient and easy to use app for beginners. It turned out that it just isn't suitable for mid- and long-term investors.

Chart intervals

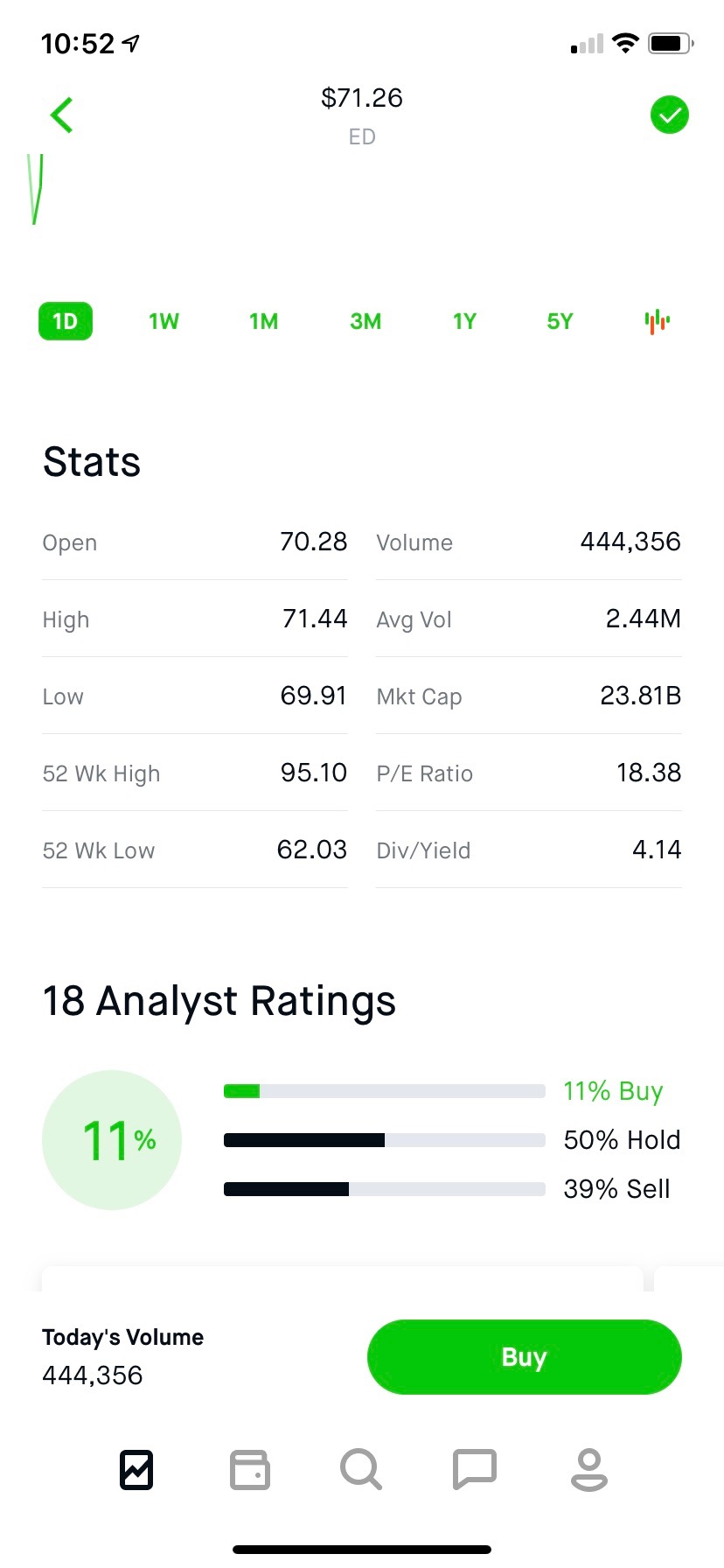

Robinhood shows all stock charts at minute intervals. Always. Even when I switch to one or five years intervals, next time, it still shows me minute charts. Even after he asked me about my investment timeline (my answer was "seven years or more"), it still shows me minute charts.

And it probably makes sense in terms of monetization and involvement. When I see how often stock prices change, I may want to start trading more actively and open the app more often. But from a user's perspective (especially if the user is a beginner), active trading will result in more losses, anxiety and stress. In a medium- and long-term trading, which is more suitable for novices, it makes more sense to check your portfolio less frequently. This is "A watched pot never boils" kind of thing.

No history for fundamental data

It shows some fundamental data on stocks but does not show how these data have changed over time. It's not that important if you're speculating on stocks, but for a long-term investor, who thinks in an "over five years" timeline, it's useful to see how the company has grown over time. How has its P/E ratio changed (is the company's growth healthy)? How did the company pay dividends? And so on.

It is also useful to see how the company's fundamental data compare with other companies in the industry or region.

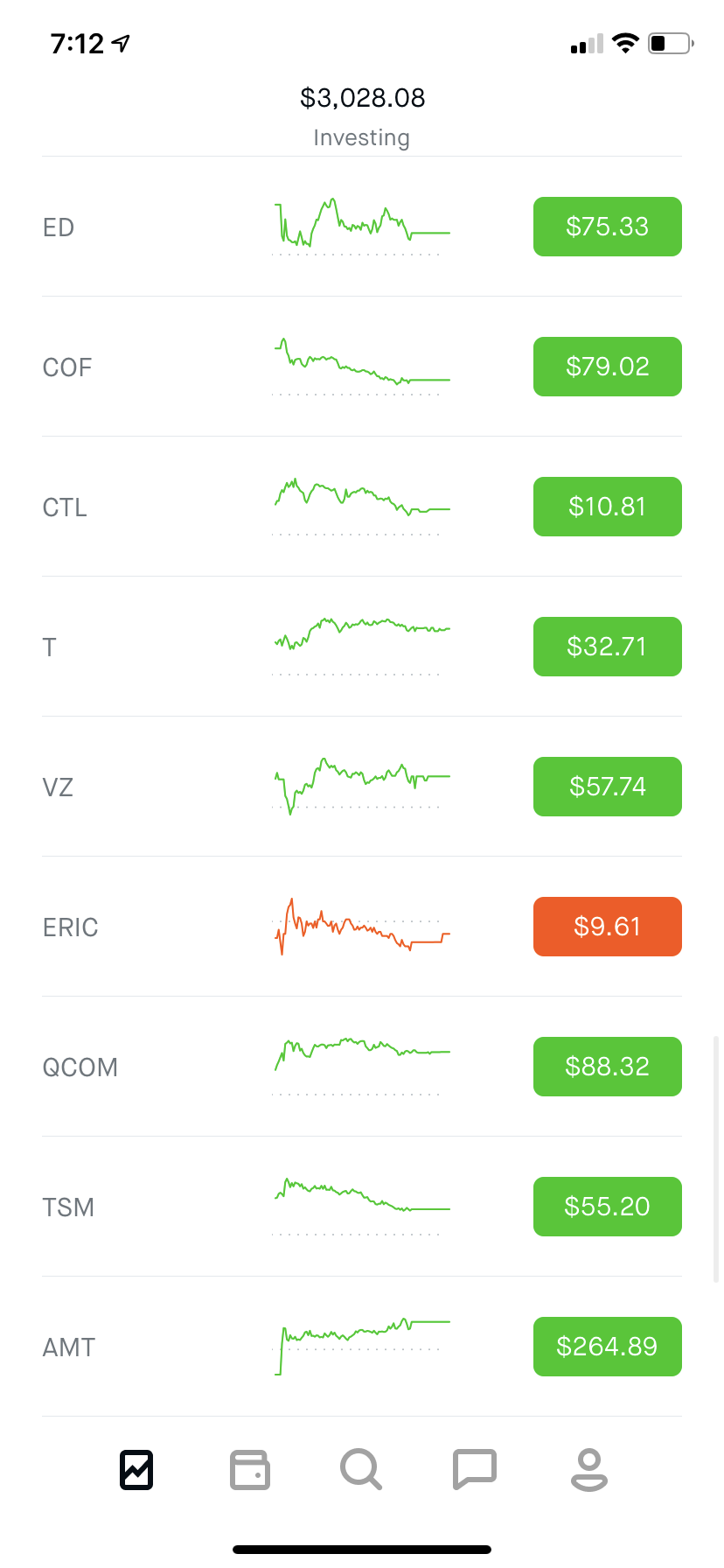

Stocks symbols

I can understand that back in the days, when stock ticker was actively used, it made sense to shorten company names to the stock symbols. This way, we could show more stocks on the limited ticker screen. But today, we are not limited by the screen size, especially on the mobile with its widespread scrolling pattern. So there is no point in showing stock symbols instead of full company names, especially for the amateur investors and beginners.

If I open the app once a week or even once a month, I have a really hard time remembering what each symbol in my watchlist means. The full company name makes a lot more sense. What's more, there's plenty of room for a brief description so that I can quickly remember what this company is about and why I added it to my watchlist.

Limited search and filters

Discoverability and search capabilities are very limited. I can only either search by the company/stock name or filter by industry.

The problem with search is that if I don't know the name of a particular company, I will never find it. The problem with industries filter is that industries are quite broad, and there is no way to narrow them down.

But as an investor, I may be interested in stocks with certain properties (p/e ratio, dividends yield, market capitalization, IPO date, etc.). Or I may want to find a company that works across several industries, or conversely, just in a narrow niche inside an industry.

Ideally, I would even want to create a smart watchlist that will automatically include/exclude stocks, based on some criteria that I define.

Why would they do that?

I think that the main reason why the app works this way (with a focus on active trading) is their monetization strategy. Let's take a closer look at how Robinhood makes money. We can notice that all of their sources of income are to some extent related to active trading:

-

Rebates from market makers and trading venues

This one is pretty straightforward: the more transactions you make, the more rebates they will get. -

Income generated from cash

Long-term investors will not have a lot of free cash in their accounts. Active traders, on the contrary, will accumulate a sufficient amount of free money on their account. Waiting for a good opportunity to enter the market. -

Robinhood Gold

Ling-term investors tools like instant deposit and margin trading. When you invest for a long period of time, a delay of five to six days (in order for the funds to become available) does not matter. While some "Gold" features may be interesting for long-term investors (e.g. Morningstar reports), in general, the value proposition of "Gold" membership is more relevant for active traders. -

Stock loan income from counterparties

Long-term investors will not buy stocks on margin or use the lever. Therefore there will be no stocks to lend. -

Cash Management

Long-term investors will likely keep all their money in stocks for a long period of time, so the volume of debit/credit card transactions will be minimal.

This does not mean that they intentionally did it badly for long-term investors. Most likely, they simply do not optimize the user experience for this category of users because they cannot monetize it properly.

Can we fix monetization?

To be honest, there are not many ways to monetize long-term investors. Especially if we want to make it “free” for the end-user.

-

Income from transactions

We can still get some income from the rebates from the market makers. But due to the trading pattern of long-term investors, the number of transactions will be very limited. So will the amount of rebates. -

Data mining

At this stage, any startup should consider its own data as a commodity that may be interesting to someone else. So, potentially, we can:- take data about our users, their transactions and portfolios,

- anonymize it,

- process it,

- find insights,

- sell those insights or anonymized and processed data to third parties.

But right now, it is not clear what insights we can find, who will be interested in buying those data/insights, so it is not clear if it can bring any money at all. Moreover, if data mining isn't done right, it can ruin the reputation and bury the product.

-

API

To provide our users with fundamental data on stocks and markets, we need to find, parse and convert them into a convenient format. There may be other third parties who would be interested in using this data in their own applications. Thus, we can share this fundamental stock and market data with them through the API.There are some existing stock data APIs: IEX Cloud, Quandl, Intrinio. It means that there is a market for such APIs/data. But it also means that we have to compete with them, which, by itself, is a whole set of problems.

-

Advertisement/leads

This is a well-established monetization strategy among personal finance services (Mint, Credit Karma, Nerd Wallet, etc.). We show our users an offer from some third-party company and get some commission if they take it.There are, however, a few challenges:

- We need to accumulate a pretty big user base to receive meaningful income from commissions.

- We need to be very careful in choosing what companies to partner with. There is a reputation risk of promoting the wrong company.

-

Subscription

This one is not "free" for the user, but the most straightforward. We can charge a monthly fee for access to the data. The problem with the subscription is that there are plenty of free data sources on the Internet. Therefore, it must be much better than the alternatives: more convenient, easier to use and indispensable for getting better results.

Conclusion

Robinhood seems like a beginner-friendly and easy-to-start investment tool. However, their app is better suited for active trading which is unsafe for beginners and might lead to losses, frustration and anxiety. To a large extent, this is determined by their monetization strategy which relies on active trading.

However, long-term investments and active trading are not mutually exclusive. There are many things, such as better fundamental data or more robust filters, that will improve the experience of both types of users and will not sacrifice monetization.